Building Wealth from Scratch in Your 20s: A Guide for the Broke

Understanding Wealth Building

Building wealth refers to the process of acquiring valuable assets and resources that generate financial security and stability over time. It encompasses not just the accumulation of money but also the establishment of a robust financial foundation through investments, savings, and thoughtful expenditure. Starting this process in your 20s is vital as it allows individuals to leverage the power of compounding interest, making a profound impact on their long-term financial situation.

It is essential to differentiate between wealth accumulation and income generation. While income generation typically involves earning a salary or wages, wealth accumulation focuses on the long-term growth of assets. For example, an individual might earn a good salary yet have minimal wealth if their spending habits do not align with savings and investment strategies. Conversely, someone with a modest income can build substantial wealth through disciplined savings and strategic investments over time. This contrast highlights the importance of understanding financial management principles to foster wealth rather than simply generating income.

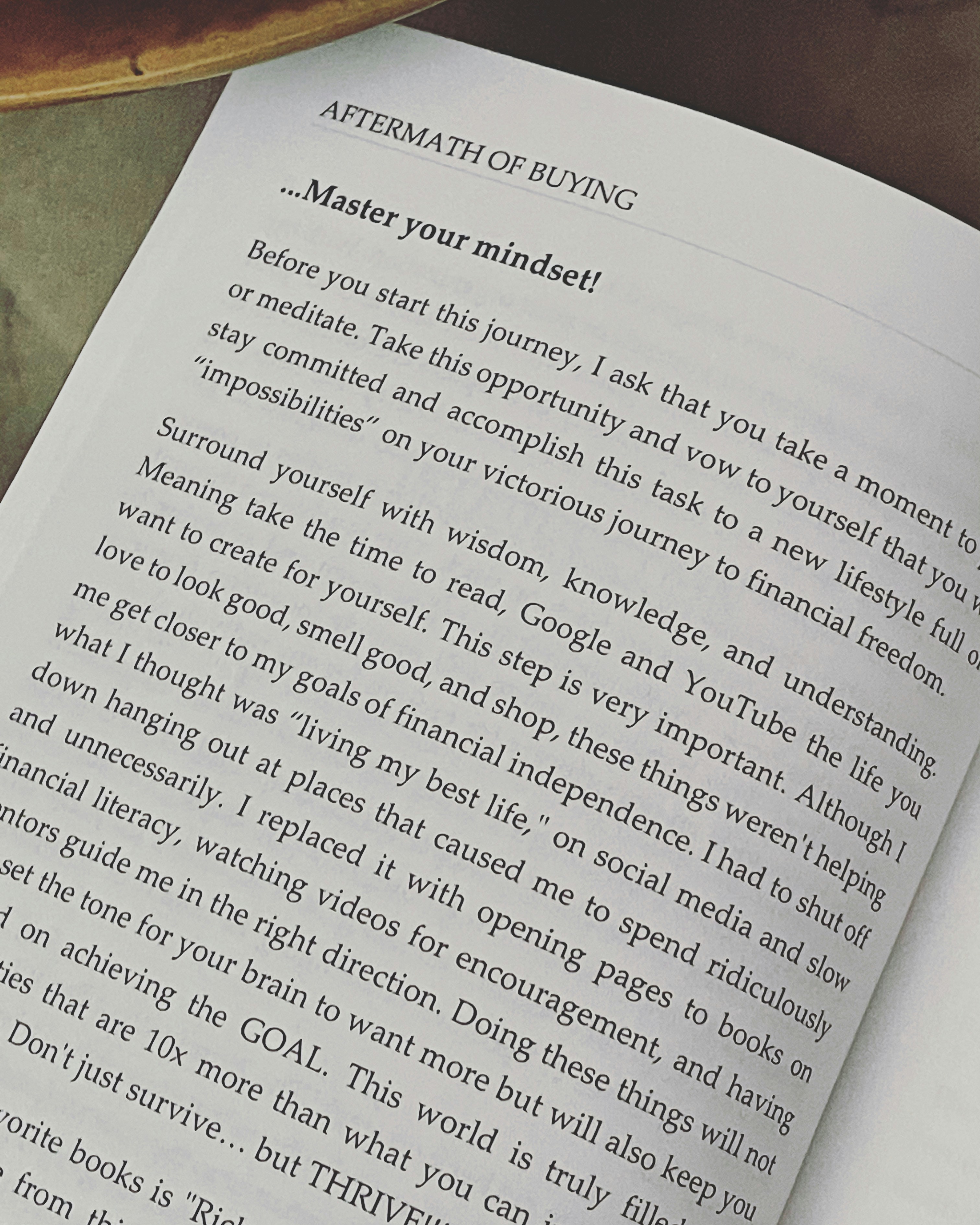

Establishing a wealth mindset is crucial for anyone looking to achieve financial success. A wealth mindset involves recognizing opportunities for investment and growth while fostering financial literacy. It encourages individuals to view challenges as learning experiences and prompts them to prioritize long-term goals over immediate gratification. Embracing this mindset can significantly influence one’s approach to spending, saving, and investing, ultimately leading to more strategic decisions that contribute to wealth-building.

In conclusion, understanding the fundamentals of wealth building is essential for young adults. By distinguishing between wealth accumulation and income generation, and cultivating a wealth mindset, individuals can set a solid foundation for their financial futures. Starting early not only enhances the potential for financial success but also instills habits that can sustain growth throughout one’s lifetime.

Assessing Your Current Financial Situation

Evaluating your current financial situation is a crucial step in the journey toward building wealth, particularly in your 20s when financial habits are still being formed. To begin, it is imperative to track your income meticulously. This includes all sources of revenue, such as your salary, freelance work, or passive income. Documenting your earnings provides a foundation for understanding your cash flow and allows you to gauge how much capital you can allocate towards savings or investments.

Next, you should assess your expenses. This involves listing all your monthly costs, including fixed expenses such as rent and utilities, as well as variable expenses like groceries and entertainment. Categorizing these expenditures can help you identify areas where you can cut back. Additionally, keeping a close eye on discretionary spending is essential, as this can often provide opportunities for savings.

Furthermore, it is important to evaluate your debts. List all outstanding obligations, including credit card debts, student loans, and personal loans. Understanding your liabilities will give you a clearer picture of your financial health and enable you to strategize on effective debt management. Lastly, take inventory of your assets, which may include savings accounts, investments, or valuable possessions. Creating a personal balance sheet to summarize your assets and liabilities will help you visualize your net worth.

Understanding where you stand financially is paramount before embarking on any wealth-building journey. It not only informs your strategy moving forward but also empowers you to set realistic financial goals. By regularly reviewing and updating your financial assessment, you can stay aligned with your objectives and track your progress effectively.

Creating a Budget that Works for You

Establishing a budget is a foundational step in building wealth, particularly for individuals in their 20s who may face the challenge of limited income yet aspire to secure their financial future. A well-structured budget serves not only as a financial blueprint but also as a tool to manage spending, save money, and create opportunities for future investment. The importance of budgeting in wealth accumulation cannot be overstated; it provides a clear view of income versus expenses, enabling informed decisions regarding financial priorities.

There are several budgeting methods to consider, each catering to different lifestyles and financial situations. One popular approach is the 50/30/20 rule, where 50% of income is allocated to needs, 30% to wants, and 20% to savings and debt repayment. This method offers a balanced way to manage essential expenses while still allowing for discretionary spending. Another effective method is the zero-based budget, which requires individuals to allocate every dollar of their income to specific expenses, savings, or debt payments, ensuring that no money goes unaccounted for. This method can be particularly effective for those who want to achieve tight control over their finances.

Budgeting is not a static process; rather, it should evolve in response to changes in income or unexpected expenses. For individuals with flexible income streams, such as freelancers or gig workers, expenses may need to be adjusted periodically. This adaptability can be achieved by revisiting the budget regularly, projecting potential changes in earnings, and establishing an emergency fund for unforeseen circumstances. By ensuring a budget is both realistic and adjustable, individuals can better navigate financial uncertainties while remaining on the path to wealth building. Ultimately, a strategic budgeting plan lays the groundwork for a more secure financial future.

Building an Emergency Fund

Establishing an emergency fund is crucial for anyone looking to build wealth, especially for individuals in their 20s who may be starting their financial journey. An emergency fund serves as a financial safety net, ensuring that unexpected expenses—such as medical emergencies, car repairs, or job loss—do not derail your financial stability. The first step in creating this fund is determining the appropriate amount to save. A common guideline is to aim for three to six months’ worth of living expenses. However, this figure can vary based on personal circumstances, income stability, and individual responsibilities.

Once you have a target amount in mind, the next challenge is how to build this fund on a tight budget. It may seem daunting, but with a strategic approach, even small contributions can lead to significant savings over time. Start by assessing your monthly expenses and identifying areas where you can cut costs. For example, consider dining out less frequently or canceling unused subscriptions. Allocate these savings directly into your emergency fund to maintain consistent growth. Automating your savings by setting up a monthly transfer to a separate savings account can also simplify the process, making it easier to build your fund steadily.

Choosing the right place to store your emergency funds is equally important. You want the money to be easily accessible in case of urgent needs, while also ensuring it is kept safe. A high-yield savings account is often recommended as it offers better interest rates compared to regular savings accounts, thus allowing your fund to grow effectively over time. Alternatively, consider a money market account or a certificate of deposit (CD) with short maturity periods. Whatever option you choose, prioritizing liquidity and security will enhance your ability to respond quickly to unforeseen financial challenges.

Investing Basics: Getting Started

Investing is a fundamental aspect of building wealth, particularly for individuals in their 20s who can leverage time to their advantage. At its core, investing involves allocating resources, usually in the form of money, to assets with the expectation of generating a return or profit over time. Understanding how to navigate various investment vehicles is critical for achieving financial goals and cultivating long-term wealth.

Among the most common investment options are stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Stocks represent ownership in a company, providing potential dividends and appreciation based on the company’s performance. Bonds, on the other hand, are loans made to corporations or governments, offering fixed interest payments and a return of principal at maturity. Mutual funds pool money from various investors to purchase a diversified portfolio of stocks and/or bonds, making them an excellent choice for beginners seeking diversification without requiring significant capital. ETFs share similarities with mutual funds but are traded like individual stocks on exchanges, allowing for flexible buying and selling throughout the trading day.

For those concerned about limited capital, starting to invest with little money is increasingly accessible. Many investment platforms and apps now offer fractional shares, enabling users to invest in high-priced stocks with smaller amounts of capital. Furthermore, opening a retirement account, such as an IRA or a 401(k), can kickstart your investing journey. These accounts often provide tax advantages that can significantly enhance the growth potential of your investments over time.

One of the most compelling reasons to begin investing sooner rather than later is the power of compound interest. This concept describes how the earnings generated by an investment can recursively generate additional earnings, leading to exponential growth over time. The earlier you start investing, even with modest sums, the more pronounced the benefits of compound interest will be. By understanding these fundamental principles and getting started with investments early, individuals in their 20s can lay a strong foundation for financial security and wealth accumulation in the future.

Exploring Side Hustles to Boost Income

In the pursuit of financial stability and wealth building, side hustles have become increasingly popular among individuals in their 20s. A side hustle serves as an additional source of income beyond one’s primary job, providing more opportunities to save, invest, and fund personal goals. Various side hustle options can cater to different skills and interests, enabling individuals to monetize their passions while enhancing their overall financial health.

One of the most accessible avenues for earning extra income is through freelance work. Platforms such as Upwork and Fiverr allow freelancers to connect with clients seeking services in writing, graphic design, web development, and more. This flexibility offers young adults the chance to leverage existing skills or even explore new areas of expertise. Alternatively, if one has a penchant for teaching, online tutoring presents another viable side hustle. Websites like Tutor.com or VIPKid provide opportunities to help students while earning competitive hourly rates.

If you possess a creative inclination, consider selling handmade products or goods through platforms like Etsy. This option not only emphasizes individual creativity but allows you to reach a global audience. Similarly, dropshipping can be a low-risk side hustle for those interested in entrepreneurship without the burden of managing inventory. By utilizing e-commerce platforms, you can sell a variety of products with minimal upfront investment.

However, balancing a side hustle with full-time employment requires careful planning and time management. Set realistic goals for your side work, and allocate specific time slots on your calendar to focus on these pursuits without compromising your main job responsibilities. Prioritizing tasks can help maintain a sustainable pace while ensuring both jobs receive adequate attention. Ultimately, diversifying your income streams through side hustles is an effective strategy for building wealth and setting a strong financial foundation in your 20s.

Understanding Credit and Debt Management

Effective management of credit and debt is a crucial component of building wealth, especially for individuals in their 20s who may be starting their financial journey. A good credit score can open doors to various financial opportunities, such as favorable interest rates on loans and better chances of securing rental agreements. Conversely, a poor credit score can significantly hinder one’s ability to access these resources. Understanding how credit works is essential for anyone who wishes to improve their financial standing and ultimately accumulate wealth.

To effectively manage credit, it’s important to focus on a few key strategies. Firstly, regularly monitoring your credit report can help identify any inaccuracies or negative entries that might be dragging down your score. Many financial institutions provide free access to credit reports, making it simpler to keep track of your score. Secondly, maintaining a low credit utilization ratio, ideally below 30%, is recommended. This means that if your credit limit is $10,000, your outstanding balance should not exceed $3,000, which demonstrates responsible use of credit resources.

Equally important is the concept of debt management, which revolves around distinguishing between good and bad debt. Good debt, such as student loans or a mortgage, often contributes positively to your financial future and can lead to wealth generation. Bad debt, on the other hand, typically involves high-interest liabilities like credit card debt that can cripple your financial situation if not managed wisely. Developing a strategy to pay off bad debt efficiently—such as the snowball or avalanche method—can help regain financial control and pave the way for more sustainable wealth accumulation over time.

In conclusion, comprehensively understanding credit and debt management is essential for developing a robust financial foundation in your 20s. By focusing on improving your credit score and managing existing debts strategically, you can enhance your capacity to build wealth and secure a brighter financial future.

Establishing Long-term Financial Goals

Establishing long-term financial goals is a crucial step for individuals looking to build wealth from scratch in their 20s. These goals serve as a roadmap, guiding decision-making and financial planning over the years. The first step in the process is to create specific, measurable, achievable, relevant, and time-bound (SMART) goals. For example, a goal such as “save for retirement” can be further refined into “contribute $300 per month to a retirement account for the next 10 years.” This clarity allows individuals to focus their efforts strategically.

Prioritizing these goals is equally important. Common objectives for young adults often include retirement savings, home ownership, and funding education. It may be beneficial to assess the timeline for each goal. While retirement savings ideally start as early as possible, purchasing a home may happen within a five to ten-year window. By understanding the urgency of each goal, individuals can allocate resources more effectively, perhaps focusing on building an emergency fund before committing substantial amounts to a property purchase.

Tracking progress is essential for maintaining motivation and making necessary adjustments. Utilizing budgeting tools or financial apps can provide insight into expenditures and investment growth. Regularly reviewing financial goals, perhaps on a quarterly or annual basis, ensures that one remains aligned with their aspirations. Documentation of achievements, even small ones, fosters a sense of accomplishment and encourages ongoing commitment to the established goals.

Integrating these financial strategies helps to cultivate a disciplined approach toward long-term wealth accumulation. By setting clear targets and monitoring progress meticulously, individuals in their 20s can establish a strong foundation, ultimately leading to financial independence in the future.

Staying Committed and Adapting Your Strategy

Building wealth is a long-term commitment that requires dedication and a well-defined strategy. To successfully navigate this journey, it is imperative to remain consistent in your efforts while also being adaptable to changes in your financial situation or life circumstances. Staying committed to your goals is crucial, as achieving financial stability is often a gradual process filled with challenges and learning opportunities.

One key to maintaining motivation is to set clear and achievable financial goals. These goals should be specific, measurable, and time-bound to help track progress effectively. Regularly reviewing these objectives encourages a sense of ownership and provides a benchmark against which you can measure your success. It is also helpful to celebrate small milestones along the way, as acknowledging progress can keep you engaged in your wealth-building endeavors.

Life can be unpredictable, and financial situations can vary significantly over time. Therefore, it is essential to regularly re-evaluate your wealth-building strategies. This can include reassessing investment portfolios, adjusting savings plans, or exploring new income streams as your career evolves. Staying informed about market trends and economic changes can provide valuable insights that will aid in adapting your approach accordingly.

Furthermore, seeking financial advice from mentors or finance professionals can offer fresh perspectives and strategies tailored to your unique circumstances. Engaging with a community of like-minded individuals who share a commitment to financial success can also enhance motivation and accountability. By surrounding yourself with supportive peers, you can foster a shared learning environment that encourages growth and adaptability.

In conclusion, the journey to wealth-building is one that demands both commitment and the flexibility to adapt. By staying focused on your goals and being receptive to change, you can navigate the complexities of personal finance and create a sustainable path toward a prosperous future.

Join Our Community

Stay connected with the latest updates, exclusive content, and be part of our growing community!

No Comments Yet